Why is Measure CC on the March 2020 ballot?

During the budget process for Fiscal Year (FY) 2019/20, the City Council approved of staff’s recommendation to add Measure CC to the Special Election ballot. While the City currently has sufficient reserves in its General Fund, its 10-year financial forecast predicts that reserves will no longer meet the State General Fund Reserve requirement by FY 2023/24.

In order to ask Culver City residents to consider Measure CC during the March 3, 2020 Special Election, the City Council had to unanimously declare a fiscal emergency (Staff Report). This is a State requirement for placing a tax measure on a ballot other than a regularly-scheduled General Municipal Election.

Is Measure CC a new/additional tax?

No. Measure CC is a continuation of the current Measure Y half-cent sales tax. Currently, Measure Y will sunset in the year 2023. If approved by Culver City voters, Measure CC would extend Measure Y by 10 more years. In other words, the sales tax rate would stay the same as it is now. The half-cent sales tax would continue to generate approximately $9.8 million dollars annually until 2033.

What is the current sales tax rate in Culver City?

The statewide sales tax rate is 7.25% and Culver City only receives funds from 1.0% out of that 7.25%. Los Angeles County, the municipalities, and districts within the County are allowed to increase the sales tax an additional 3.00%, up to a combined total of 10.25%. Over 20 L.A. County cities, including Culver City, currently have a sales tax rate of 10.25%.

Why would a City want to have the maximum sales tax rate?

Between L.A. County and the City of Culver City, there can be an additional 3.00% of sales tax on top of the statewide sales tax rate of 7.25%. Los Angeles County has claimed 2.25% of the allowed 3.00% through its own sales tax measures. In 2012, Culver City voters approved Measure Y: a half-cent local sales tax that generates approximately $9.8 million dollars annually. In November 2018, Culver City voters approved Measure C: a quarter-cent sales tax that generates approximately $4.9 million dollars annually. Through Measure C and Measure Y, Culver City has claimed the remaining 0.75% of the allowed 3.00%.

All the revenue generated by that 0.75% of sales tax--approximately $14.7 million dollars annually--stays in Culver City. None of that revenue goes to the County or the State. If voters approve Measure CC, that $9.8 million in sales tax revenue will remain available for City services. If voters disapprove Measure CC, then the County could pass a new sales tax that might not have direct benefits to the community, and that would prevent the City from increasing its own sales tax because of the overall 10.25% cap imposed by state law.

Is Measure CC a special tax or a general tax?

Measure CC is a general tax. It proposes to continue a one-half-percent transactions and use tax, commonly known as a sales tax, whose revenue would be deposited into the City's General Fund rather than go to the State or County. The revenue from this sales tax could be used for any valid general municipal purpose. As a general tax, Measure CC will require approval by a simple majority ("50 percent plus one") of those voting on the measure.

What are some of the financial challenges facing Culver City?

Maintenance and capital improvement projects for City infrastructure, spanning streets, roads, pavements, traffic safety projects and city buildings. Consultants at Faithful Gould found $38 million in necessary capital improvements at 25 City-owned structures over a 10-year period. Out of the $38 million, $20 million in improvements has been identified as immediate and $8.5 million were identified as Priority 1 Life/Public Safety items.

Capital and maintenance expenditures for network infrastructure, cloud-based software deployments and replacement of end-of-life hardware that streamline and facilitate efficient operations.

How will Measure CC appear on the March 2020 ballot?

"CONTINUATION OF CITY SERVICES TRANSACTIONS AND USE TAX. Shall the measure to maintain 911 emergency response services by training firefighters/police officers/paramedics; addressing homelessness; fixing potholes/streets; maintaining storm drains, parks, after-school programs, senior services, and other general fund services, by continuing the voter-approved one-half cent sales tax, generating approximately $9.8 million dollars annually, until March 31, 2033, requiring independent annual audits, all funds used locally, with no tax rate increase, be adopted."

What could happen if Measure CC does not pass?

Without the revenue that Measure CC would provide, the City would likely not be able to continue to provide the same level of service it provides today. That could involve cutbacks to essential services such as 911 emergency and paramedic response, police and fire protection, programming for parks, recreation and seniors, as well as fixing streets and potholes might be necessary.

How does Culver City use sales tax revenue?

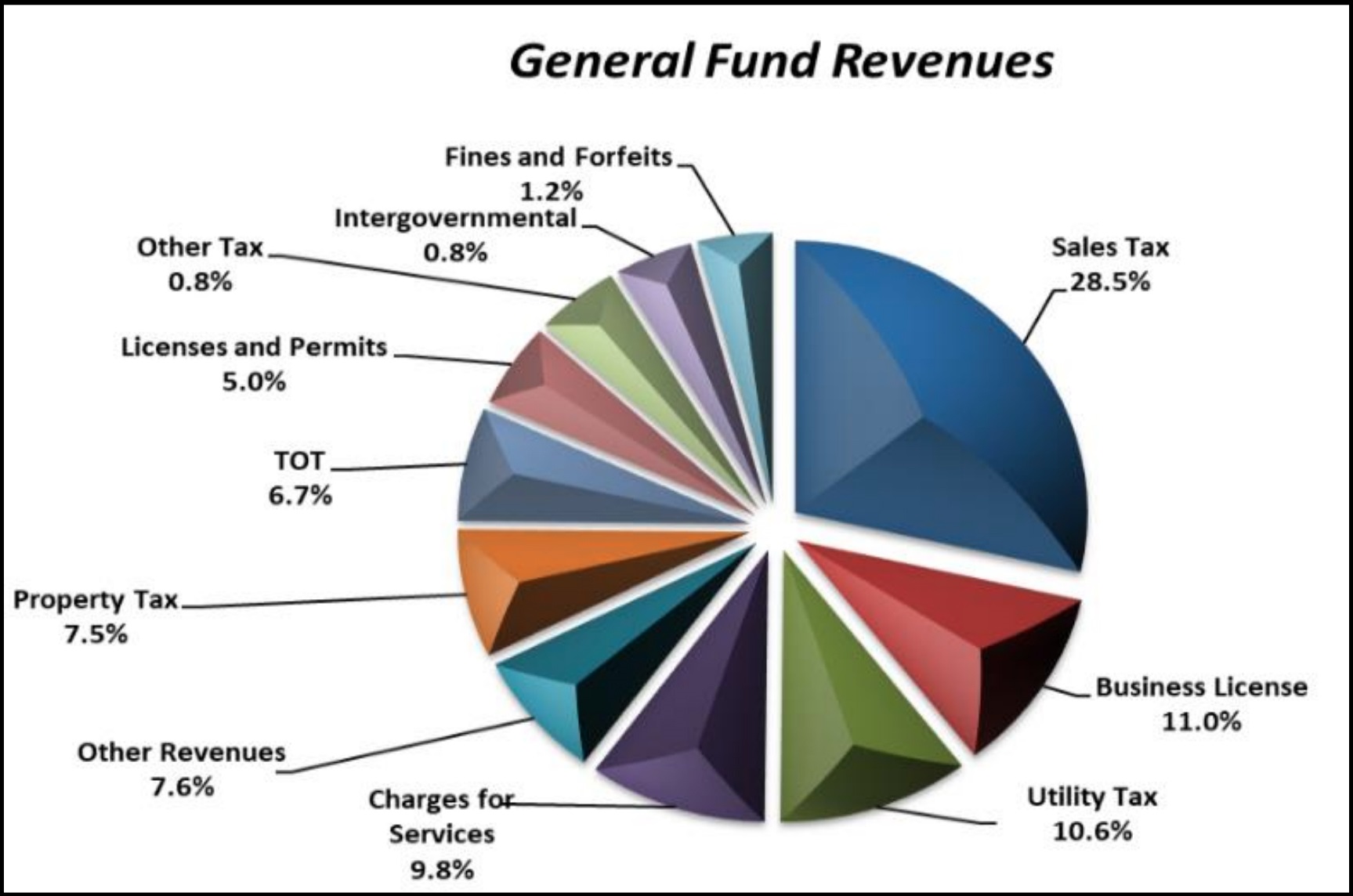

Sales tax is the City’s largest tax revenue source in the City: currently, 28.5% of the General Fund revenue comes from sales tax. All the revenue generated by Culver City sales taxes goes into the City's General Fund, which can only be spent on City resources, services and programs, such as Police, Fire, Public Works and Parks. The Measure Y and Measure C sales taxes generate approximately $14.7 million dollars annually for the City's General Fund.

General Funds Revenues